TL;DR

- With de minimis removed, every import now faces duties, taxes, and carrier fees—no exceptions.

- Small brands must show full landed cost upfront to prevent surprises, rejections, and margin loss.

- Key disclosures include duty/tax estimates, shipping, processing fees, origin impact, and returns rules.

- Clear DDP options and automated HS/currency tools restore trust and pricing accuracy.

- KlearNow enables full transparency with automated landed-cost calculations and clean trade data.

The old de minimis rule no longer protects online retailers and e-commerce brands heavily involved in cross-border transactions. The removal of that threshold means every package entering the United States now carries duty and tax exposure, and that shift has made the free shipping offers customers have come to expect almost impossible to offer, leading to higher costs for goods.

To build trust that overcomes such an alarming shift, full transparency is key. These retailers must now disclose the full landed cost calculation to customers, showing exactly what they will be paying, to avoid surprises.

“Free Shipping” No Longer Wins Trust

U.S. de minimis rule once removed the need for duties and taxes on low-value imports. The elimination of the threshold means that even a $15 item shipped into the United States will incur duties, taxes, and processing charges. That shift is forcing brands to replace vague “free shipping” claims with full landed-cost clarity or risk losing customers.

U.S customers are already wary enough of tariffs, and surprising them with an unexplained price increase can turn them off. It is the kind of response that highlights why it is so important that visibility replaces guesswork. “Customers judge fairness by what they know before payment, not after delivery,” said Scott Luton, host of Supply Chain Now. His point captures the shift in expectations with direct force.

The main idea is simple: if the buyer cannot predict the full cost, they won’t trust the brand.

Hidden Costs Hurt Growth for Small D2C Brands

The removal of de minimis has made U.S. deliveries that were previously exempt from customs treatment subject to the full import duty. That shift adds customs processing charges, even for low-value goods. And small brands shipping beauty items, electronics accessories, home goods, and apparel now face a higher burden when they fail to calculate landed cost in advance.

A simple example: A $20 T-shirt sent from Asia used to be duty-free. Under the new rule, the same T-shirt may generate a 16% duty rate, plus carrier processing fees. Many buyers will reject packages when asked to pay these amounts at delivery, which raises shipping costs, increases the risk of damaged goods, and erodes profit margins. This is why brands can no longer rely on generic pricing pages. They need a clear cost breakdown that explains freight, insurance, customs duties, and any additional fees associated with the buyer’s destination country.

What Small Brands Must Now Disclose

Small brands shipping to the United States must share every element that affects total landed cost. These disclosures reduce disputes, improve trust, and protect repeat sales. Here are some of the key disclosures:

1. Duties and Taxes Breakdown

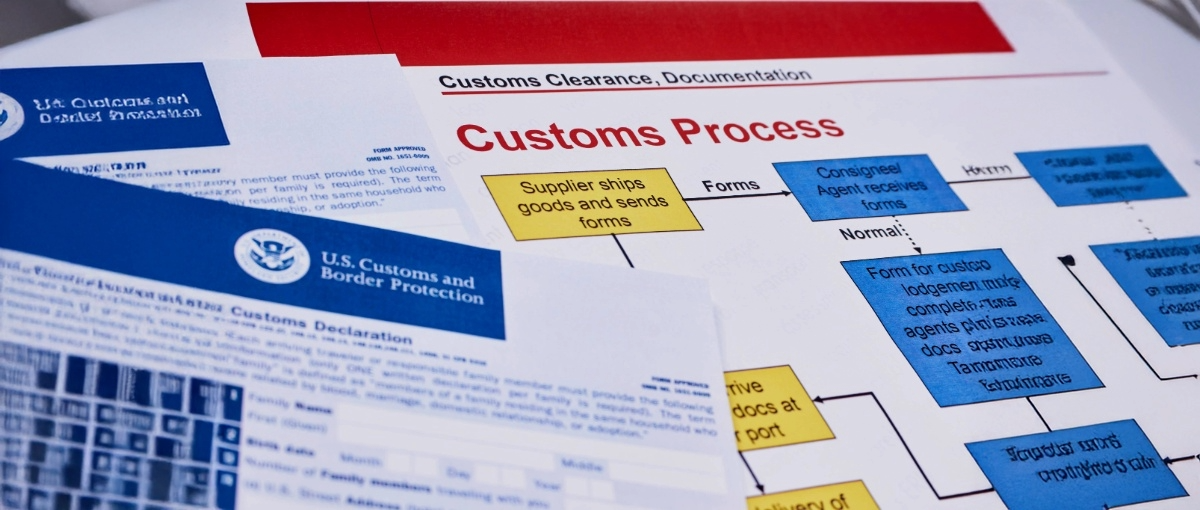

Buyers must see the duty estimate before checkout. Duty rates depend on HS code, material, and origin. U.S. Customs and Border Protection states that duty rates apply regardless of product value under the new rule. This means brands must reveal these charges early and in plain english. For example, a line, such as “Estimated duty and import tax based on product origin,” can help buyers make informed decisions without confusion.

2. Brokerage and Clearance Fees

Carriers add processing charges even on small boxes. And these fees vary depending on the service level and package type. A buyer may pay $10–$25 in added charges, which can feel unfair without warning. Telling buyers that “carrier processing fees may apply under U.S. import rules” helps set expectations and prevents rejections.

3. Rules of Origin and Tariff Impact

The origin of each product now shapes the cost more than buyers realize. Goods from some regions may face tariff lines that raise duty, while goods from nearby regions may pay far less. You do not need to explain trade law. You only need to say that origin affects duty and will be reflected in the landed cost calculator on your store.

4. Returns Duty and Tax Exposure

Under the new conditions, buyers may not receive a refund of duties or taxes on returned goods. That detail can upset customers if they learn it too late. A clear statement, such as “Duties and taxes may not be refunded on returns due to U.S. import rules,” builds trust.

Ultimately, silence costs more than disclosure.

Practical Steps Small Brands Can Take Now

Small brands can strengthen trust by adjusting product pages, checkout flows, and customer-service scripts. These steps help buyers understand the total cost from the factory floor to the buyer’s door.

1. Add a Landed Cost Breakdown

Place a simple table or collapsible panel on product and checkout pages that lists:

- item price

- shipping

- duty estimate

- tax estimate

- expected clearance charge

This structure shows the buyer exactly how you calculate their cost.

2. Offer Pre-Paid Duties and Taxes (DDP)

DDP prevents last-mile surprises. When buyers pay upfront and in full, shipments reach the customers faster and with minimal interruption. This boost in predictability leads to smoother delivery and fewer rejected boxes.

3. Publish a Clear Returns Duty Statement

A clear and direct returns policy that outlines what customers can expect if they choose to make a return prevents confusion. Customers appreciate honesty more than perfect conditions. And when returns are not straightforward, it can be a huge turn-off.

4. Use Tools That Pull HS Codes and Exchange Rates Automatically

Manual classification creates errors that lead to misrated shipments and penalty risk. Automated tools improve accuracy and help brands set pricing strategies rooted in real costs rather than guesswork.

5. Run Quarterly Checks on Product Data

Tariff schedules, product attributes, and supplier declarations are subject to change. You don’t want to tell customers one thing, but in reality, it is another. The good news is that a simple quarterly audit protects the brand from incorrect duty rates.

6. Train Support Teams on Cost Basics

Your team must understand duties, taxes, and return rules. When support teams speak with clarity, customers feel respected. These steps create consistency, which in turn builds trust.

How KlearNow Helps Small Brands Deliver Full Transparency

KlearNow supports small brands that want clean data, faster clearance, and accurate landed-cost visibility. The platform provides brands with the information they need to show customers a fair price without confusion, including automated landed cost calculation, accurate HS codes, and a unified trade data view.

Transparency is no longer a courtesy. It is the price of entry for global retail. Small brands that reveal every cost gain confidence, while those that hide costs lose buyers. Small brands that update their product and fulfillment model now will grow faster, ship smoother, and protect trust with every sale.

Frequently Asked Questions

1. How does the removal of U.S. de minimis change the total landed cost for imported goods?

The removal raises the total landed cost because every package now moves through full duty review. That means brands must include customs duties, shipping fees, freight cost, insurance cost, and any charges incurred during clearance. These changes affect pricing strategies and push brands to calculate landed cost with more detail so buyers understand the full price.

2. Do fees vary depending on the destination inside the U.S.?

Yes. Fees vary depending on the carrier, package type, and the destination country code used during processing. Some hubs add additional fees tied to route design or payment processing. These shifts affect profit margins, so brands need a clear landed cost formula that captures these movements in a simple way.

3. How should brands handle currency conversion when selling to U.S. buyers?

Brands need a cost calculator that updates exchange rates in real time. A weak rate can raise the total cost, while a strong one can create cost savings. Since the U.S. now charges duty on all shipments, poor currency conversion can hurt the business model and confuse customers who expect clean price signals.

4. What other costs should brands share with buyers now that de minimis is gone?

Brands should disclose every cost that touches the box: shipping, taxes, other charges, insurance, freight, and duty estimates. These details help customers make informed decisions and reduce shock at delivery. Even small expenses matter because they shape trust and influence repeat buying behavior.

5. How can small brands build trust while keeping profit strong under the new rules?

Small brands can build trust by sharing a full landed cost calculation before checkout. Clear duty estimates, a clean list of other costs, and a simple note on returns help customers feel respected. This clarity protects profit, supports better pricing, and keeps the business steady even when rules change.